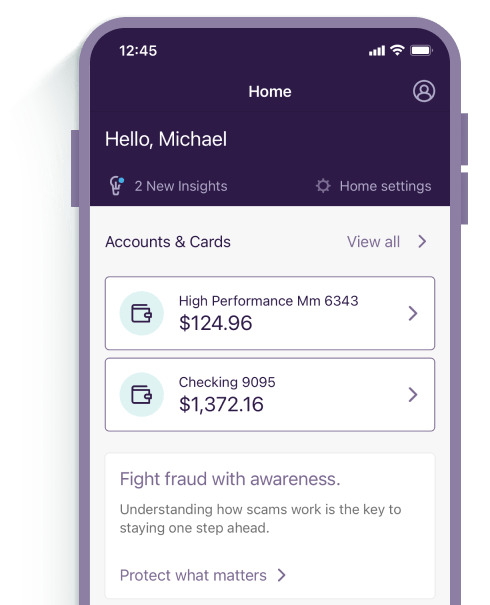

Get super-fast access to your accounts and bright insights into your spending with our mobile app.

Scan this code with your phone’s camera to download Truist Mobile.

Advanced security

Your information can never be too secure. Encryption and our multilayered approach protects your personal information anytime and anywhere you use our technology.

Card controls

Lock and unlock them, control them when you travel, and set spending limits.

Customized alerts

Get notified about important account activities. From daily balances and overdrawn accounts to user ID changes—we’ve got you covered.